District Sales

We also have plenty of plat books to choose from! There are some 2006, 2014, 2019, and the most recent: 2022!

2006 and 2014: $5 each

2019: $20 each

2022: $50 each

Don't forget your wall maps! If you'd like a large map of the county, we can get you fixed up! Wall maps are $100 each.

2006 and 2014: $5 each

2019: $20 each

2022: $50 each

Don't forget your wall maps! If you'd like a large map of the county, we can get you fixed up! Wall maps are $100 each.

Irrigation Specialist

Our Irrigation Water Management Specialist assist landowners with flowing wells, Pipe Planner designs, soil moisture sensors, and more!

Earth Team Volunteer Program

Volunteering has always been a cornerstone of America’s soil and water conservation movement. It formally began in the 1930s with the organization of local conservation districts. Then, as now, people volunteered their time and talent as district supervisors to assist the Natural Resources Conservation Service (NRCS) in getting conservation practices on the land. In expanding the volunteer concept, Congress passed legislation in 1981 which allowed NRCS to use volunteers in all of its programs.

In 1986, the National Volunteer Program became known as the “Earth Team”, the volunteer arm of the Natural Resources Conservation Service. The primary purpose of the Earth Team is, and always has been, to expand the

NRCS services by using volunteer time, talent, and energy to help meet agency needs.

The Earth Team is now an organized and recognized part of NRCS's operations. NRCS employees at the national, regional, state, and local level recruit and utilize volunteers for a wide variety of activities.

As it was in the beginning, the Earth Team is looking for volunteers who have an interest in conserving natural resources. Who can volunteer? Anyone 14 years of age or older and interested in conserving our precious natural resources can be an Earth Team volunteer. You can volunteer part-time or full-time and work outdoors or in a local NRCS office. You can volunteer as an individual or form or join a group. For more information on becoming an Earth Team volunteer call us at 870-236-2446 Extension 3, or fill out the application below and bring it to the office.

In 1986, the National Volunteer Program became known as the “Earth Team”, the volunteer arm of the Natural Resources Conservation Service. The primary purpose of the Earth Team is, and always has been, to expand the

NRCS services by using volunteer time, talent, and energy to help meet agency needs.

The Earth Team is now an organized and recognized part of NRCS's operations. NRCS employees at the national, regional, state, and local level recruit and utilize volunteers for a wide variety of activities.

As it was in the beginning, the Earth Team is looking for volunteers who have an interest in conserving natural resources. Who can volunteer? Anyone 14 years of age or older and interested in conserving our precious natural resources can be an Earth Team volunteer. You can volunteer part-time or full-time and work outdoors or in a local NRCS office. You can volunteer as an individual or form or join a group. For more information on becoming an Earth Team volunteer call us at 870-236-2446 Extension 3, or fill out the application below and bring it to the office.

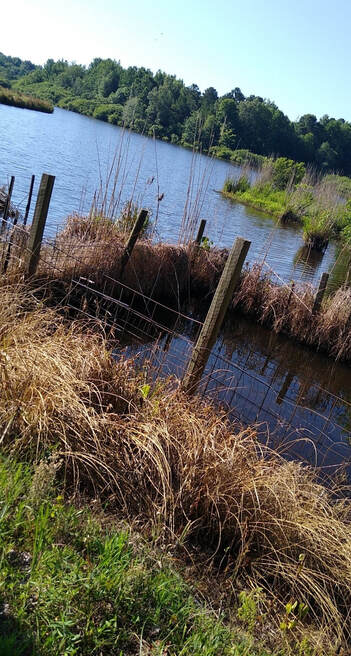

Beaver Control Program - FY 2024

|

This plan is effective from July 1, 2024 until June 30, 2025. The Greene County Conservation District will pay $15.00 per beaver. State funds $10.00; Local funds $5.00. The District Board hereby designates Tanginna Atwood as the Beaver Control Officer (BCO) for Greene County.

The following documents must be received by the BCO:

Bounty will not be paid until these documents are received. Tails will be turned in to the BCO at the Greene County Conservation District office on Friday mornings from 7:30am to 8:30am. A limit of 30 tails per week, per trapper is set by the District Board. Bounty will be paid until funds are depleted. |

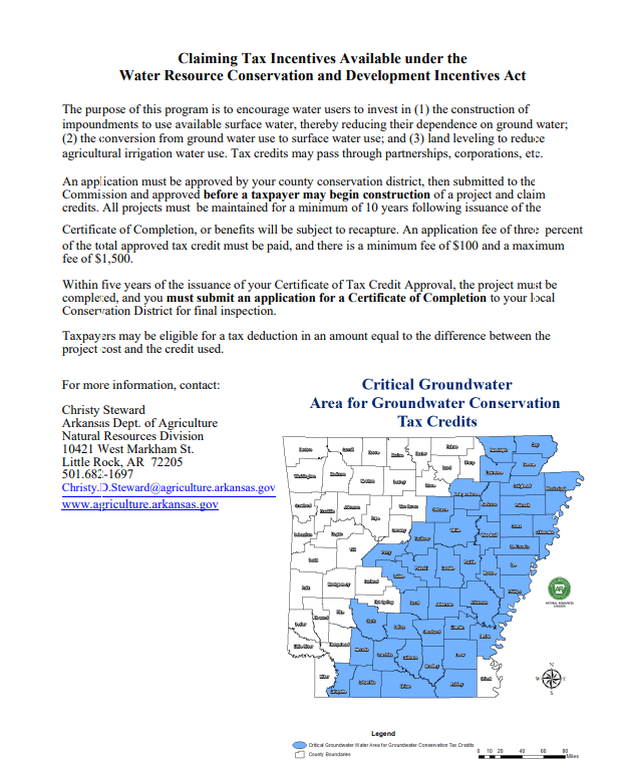

Tax Credits

Arkansas Landowners may be eligible for credits on the following:

Reservoirs:

Inside a Critical Groundwater Area:

Reservoirs:

- 50% of the project cost of at least 20 acre-feet.

- Claim up to $18,000 in one taxable year.

- Unused credit may be carried over for a maximum of 15 years.

- Maximum amount one can claim for this project is $120,000.

- 25% of the project cost.

- Claim up to $18,000 in one taxable year.

- Unused credit may be carried over for a maximum of 15 years.

- Maximum amount one can claim for this project is $35,000.

Inside a Critical Groundwater Area:

- 50% of the project cost.

- Claim up to $18,000 in one taxable year.

- Unused credit may be carried over for a maximum of 15 years.

- Maximum amount one can claim for this project is $35,000.

- 25% of the project cost.

- Claim up to $18,000 in one taxable year.

- Unused credit may be carried over for a maximum of 15 years.

- Maximum amount one can claim for this project is $35,000.

- Receive 25% or 50% off cost of water meters installed on wells.

- No pre-approval required.

Contact your local conservation district office to start the application process!

Additional Questions? Visit agriculture.arkansas.gov/natural-resources/division/water-management/tax-credits or call (501 682-1697 for more information!

Additional Questions? Visit agriculture.arkansas.gov/natural-resources/division/water-management/tax-credits or call (501 682-1697 for more information!

| Tax Incentives Application | |

| File Size: | 149 kb |

| File Type: | |

Specialty License Plates

Help your Conservation District by purchasing a specialty license plate for $35.00!

For every plate bought in your county, the Conservation District will receive $20.

Visit your county revenue office to get yours today!

For every plate bought in your county, the Conservation District will receive $20.

Visit your county revenue office to get yours today!